Understanding Trading Signals: What They Are and How to Use Them

Trading signals are essential tools in the dynamic world of financial markets, providing traders with guidance on potential buying or selling opportunities. These signals can be classified based on their sources, which include technical analysis, fundamental analysis, and sometimes sentiment analysis. They serve as indicators that assist traders in making more informed decisions in their trading endeavors.

One of the prominent types of trading signals is Forex trading signals, which specifically cater to currency pairs. These signals signify optimal points to enter or exit trades in the forex market. Traders who rely on Forex signals typically utilize them to leverage the volatility of currency movements, allowing them to maximize potential profits. Similarly, stock trading signals offer insights tailored to the stock market, often based on economic indicators, price movements, and earnings reports. Understanding both Forex and stock trading signals is crucial for traders looking to capitalize on various market opportunities.

Real-time trading signals are particularly vital for traders, as they provide immediate data that can influence quick decision-making. By accessing real-time signals, traders can respond to market conditions as they unfold, enhancing their ability to predict price movements. Many traders subscribe to trading signal services that send SMS or email notifications with actionable insights, ensuring they remain updated on market developments.

To utilize trading signals effectively, traders should develop a well-rounded strategy that incorporates these signals into their overall trading plan. This includes evaluating the reliability of the source of the signals, understanding the market context, and combining signals with personal research and analysis. By doing so, traders can improve their chances of making profitable transactions while minimizing risks associated with market fluctuations.

Navigating the Forex Market Hours

The Forex market operates 24 hours a day, five days a week, but it is crucial for traders to understand the significance of timing their trades according to the various trading sessions. The market is divided into three major segments: the Asian session, the European session, and the North American session. Each session brings unique characteristics and levels of volatility, which can significantly influence trading outcomes.

The Asian session, which begins at 11 PM GMT and ends at 8 AM GMT, is often regarded as the quieter period in the Forex market. Given the reduced trading volume, currency pairs such as the Japanese Yen and Australian Dollar become particularly prominent during this time. Traders should note that while price movements may be limited, trading strategies that capitalize on these quieter moments can still be effective.

The European session starts at 7 AM GMT and concludes at 4 PM GMT. This session typically sees the highest activity, as various European financial institutions are open. The influx of traders and liquidity during this time results in increased volatility, presenting opportunities for significant price movements. Currency pairs involving the Euro, British Pound, and Swiss Franc become more attractive for traders during this session, making it an ideal time for executing trades based on technical and fundamental analyses.

Finally, the North American session begins at 1 PM GMT and lasts until 10 PM GMT. Coinciding with the closure of the European session, this overlap often triggers notable market volatility. The US Dollar’s role as a global reserve currency means that trading in this session frequently impacts other currencies. Trading strategies that exploit news releases and economic reports from the United States can yield profitable results during this active period.

In essence, aligning trading activities with the dynamics of different Forex market sessions allows traders to maximize their potential. By understanding when the market is most active, traders can better position themselves to take advantage of currency price movements and optimize their overall results.

Staying Informed: The Role of Trading News in Decision-Making

In the fast-paced world of trading, staying informed is paramount for making effective trading decisions. Trading news and economic indicators play a crucial role in shaping market dynamics and influencing price movements. For traders, understanding the potency of news releases can provide invaluable insights into market volatility and the trends that may arise in response to global events or economic reports.

Economic indicators, such as GDP growth, inflation rates, and employment numbers, serve as essential data points that reflect a country’s financial health. Traders closely monitor these indicators as they can lead to significant market reactions. For example, a stronger-than-expected jobs report may result in bullish sentiment for a currency, prompting traders to adjust their positions accordingly. Conversely, disappointing economic data may drive prices down, creating a prime opportunity for short-selling. Hence, being aware of such indicators allows traders to make more informed decisions based on the anticipated market impact.

Moreover, real-time news feeds and economic calendars are valuable tools that traders utilize to stay updated. Through platforms that aggregate news from reputable financial sources, traders can receive alerts on crucial developments, allowing them to react promptly to emerging trends. Furthermore, integrating technical analysis with fundamental news can provide a comprehensive trading strategy. For instance, applying technical indicators can help confirm the implications of the latest news, thereby strengthening one’s trading approach.

Interpreting news requires a nuanced understanding, as not all news will have the same impact. Traders must discern the significance of news releases in context, considering whether they align with existing market sentiment. This critical analysis will enable traders to leverage insights from news events effectively, positioning them advantageously within the trading landscape. By remaining vigilant and adaptable to news changes, traders can optimize their trading outcomes and enhance their overall market understanding.

Technical Analysis Tools: Candlestick Patterns, Support and Resistance, and Charts

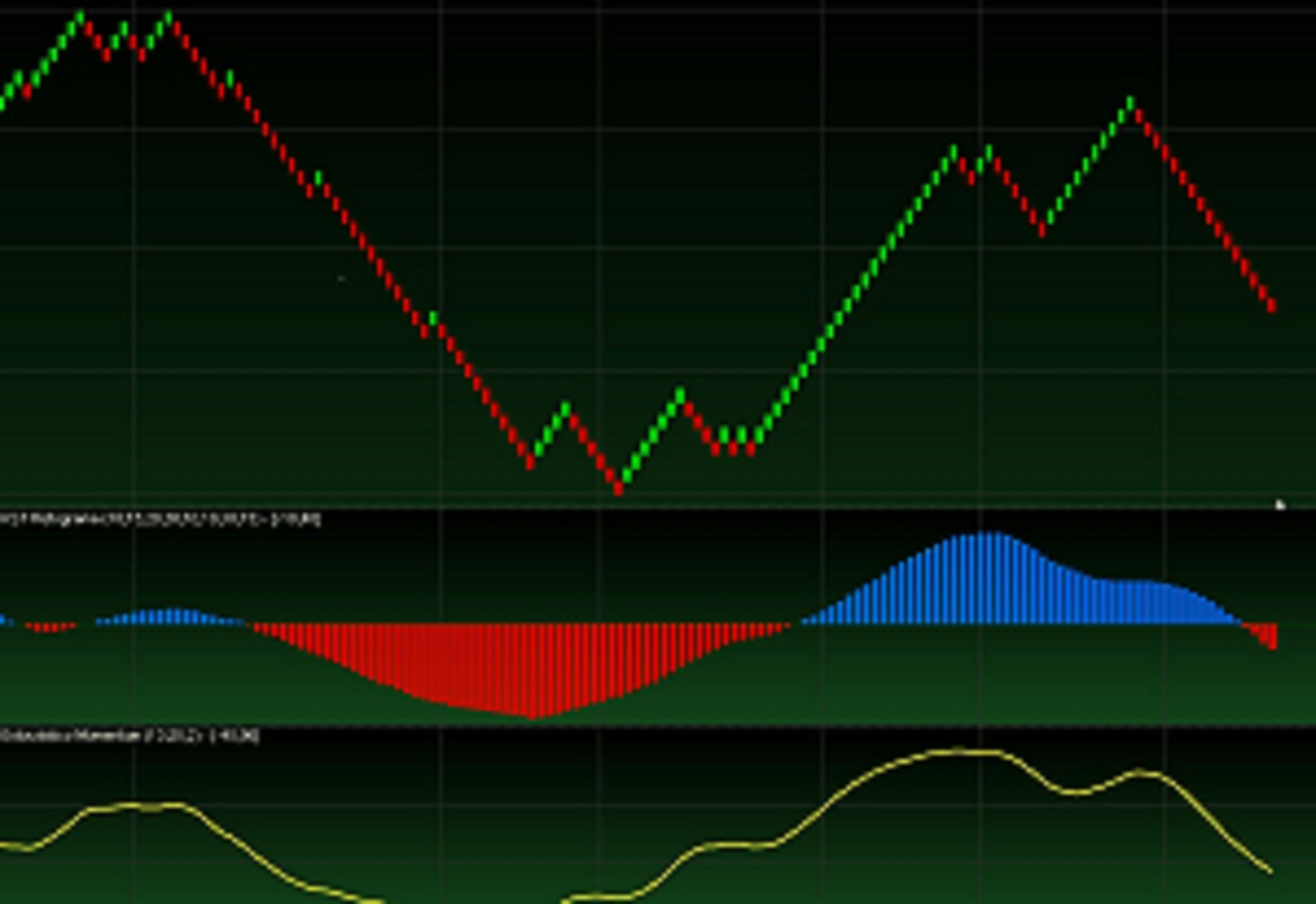

Technical analysis is an essential component for traders seeking to maximize their potential in the financial markets. A variety of tools are utilized in this analytical framework, with candlestick patterns, support and resistance levels, and charts standing out as particularly useful. These instruments allow traders to identify market trends, predict future price movements, and formulate effective strategies.

Candlestick patterns are visual representations of price movements over specific periods. Each candlestick provides insight into the open, close, high, and low prices, enabling traders to decipher market sentiment. For instance, a “bullish engulfing” pattern indicates a potential upward price movement, suggesting that traders might consider buying. Conversely, a “bearish engulfing” could signal a decline, prompting selling activity. Recognizing these patterns is crucial, as they highlight shifts in momentum, offering traders vital information to guide their decisions.

Support and resistance levels are equally important in technical analysis. Support refers to a price level where a downtrend can be expected to pause due to increased buying interest, while resistance denotes a price level where an uptrend can be halted due to selling pressure. Identifying these levels is fundamental, as they help traders gauge potential entry and exit points. For example, if a stock consistently bounces off a support level, it may indicate a buying opportunity, whereas repeatedly failing to break through a resistance level could signal a time to sell.

Lastly, stock charts serve as a graphical representation of price movements over time, enabling traders to visualize trends and patterns. Various types of charts, such as line, bar, and candlestick charts, capture market dynamics and enhance the trader’s ability to analyze past performance while strategizing for future trades. By interpreting these technical analysis tools, traders can refine their strategies and make informed decisions in their trading endeavors.